No Interest Loan Scheme (NILS)

Loans you can actually afford

Can’t afford to replace your broken fridge? Is your car in need of repairs to get you to work? Many people have moments like these.

Money stress can make us consider solutions that might not be ideal. Renting appliances or getting a quick cash loan may seem like easy options but they’re very costly, with hidden interest rates and extra fees.

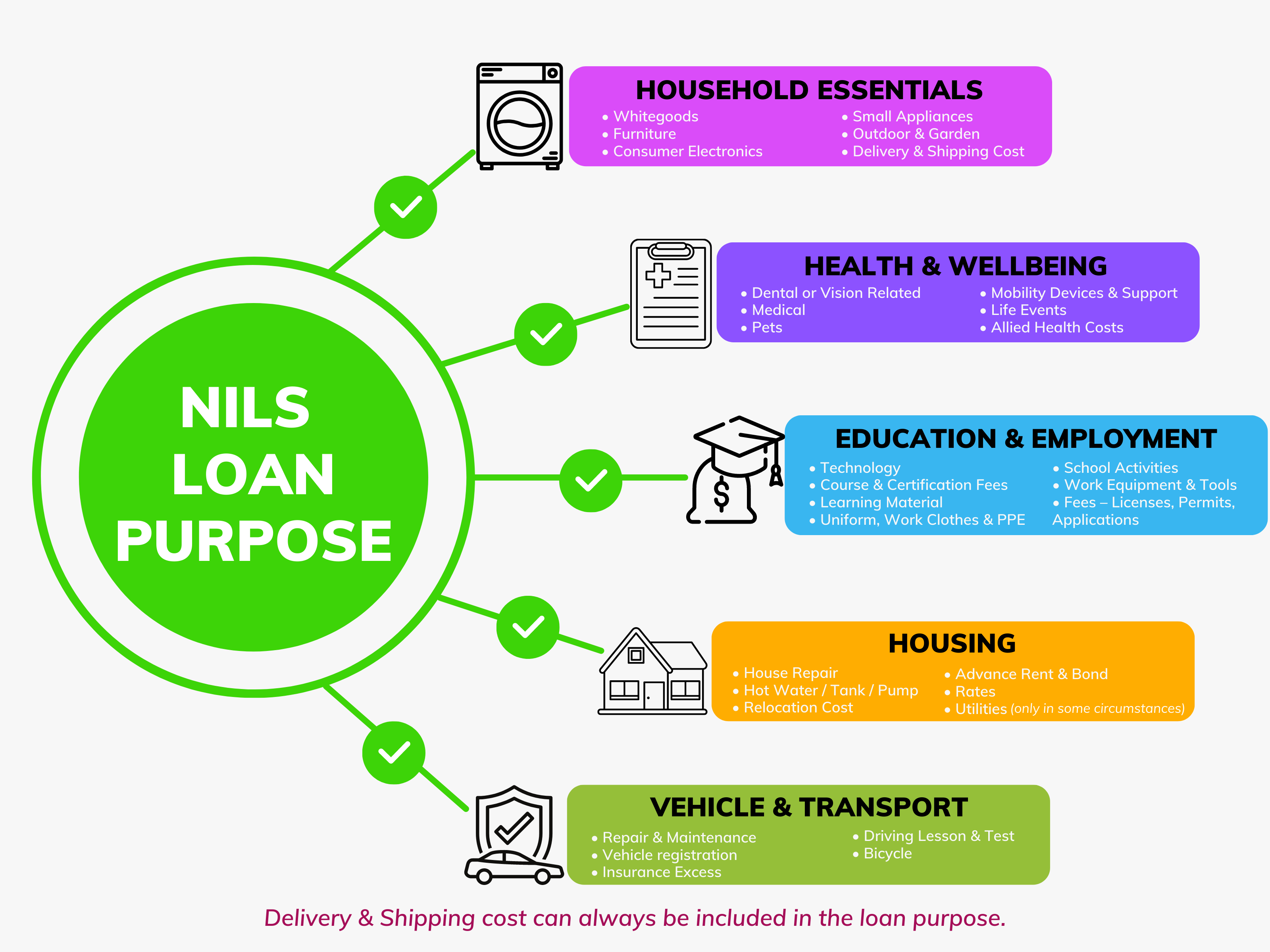

No Interest Loans are a smart loan option to help you manage your money. Borrow up to $2000 for essentials such as appliances or furniture, to help you get your car back on the road, pay for education fees and equipment or help you cover the cost of goods and services to support your wellbeing.

Borrow up to $3000 for housing-related expenses such as bond or rent in advance, or for recovery from a natural disaster.

What can't No Interest Loans cover?

Call our National Intake Line on (02) 6241 0518 or email nils@salvationarmy.org.au

The Salvation Army is an accredited provider of the No Interest Loan Scheme by Good Shepherd Australia New Zealand.

Frequently asked questions

You can apply for a loan if you:

- Earn less than

- $70,000 annual income (before tax) as a single person or

- $100,000 annual income (before tax) if you have a partner or dependants

- OR Have experienced family or domestic violence in the last 10 years

- OR Have a Heath Care Card or Pension Card

- AND You can show you have the capacity to repay the loan

Borrow up to $2000 for essential goods and services including:

- Household appliances

- Car-related items (for example repairs, registration fees or driving lessons)

- Beds/mattresses

- Computers

- Certain kinds of home repairs

- Health items, medical and dental equipment or aids

- Cost of relocation, funerals or veterinary expenses

- Bond and rent in advance (for new lease only)

- Council Rates

Borrow up to $3,000 for:

- Bond & rent in advance

- Rates

- Costs associated with a natural disaster

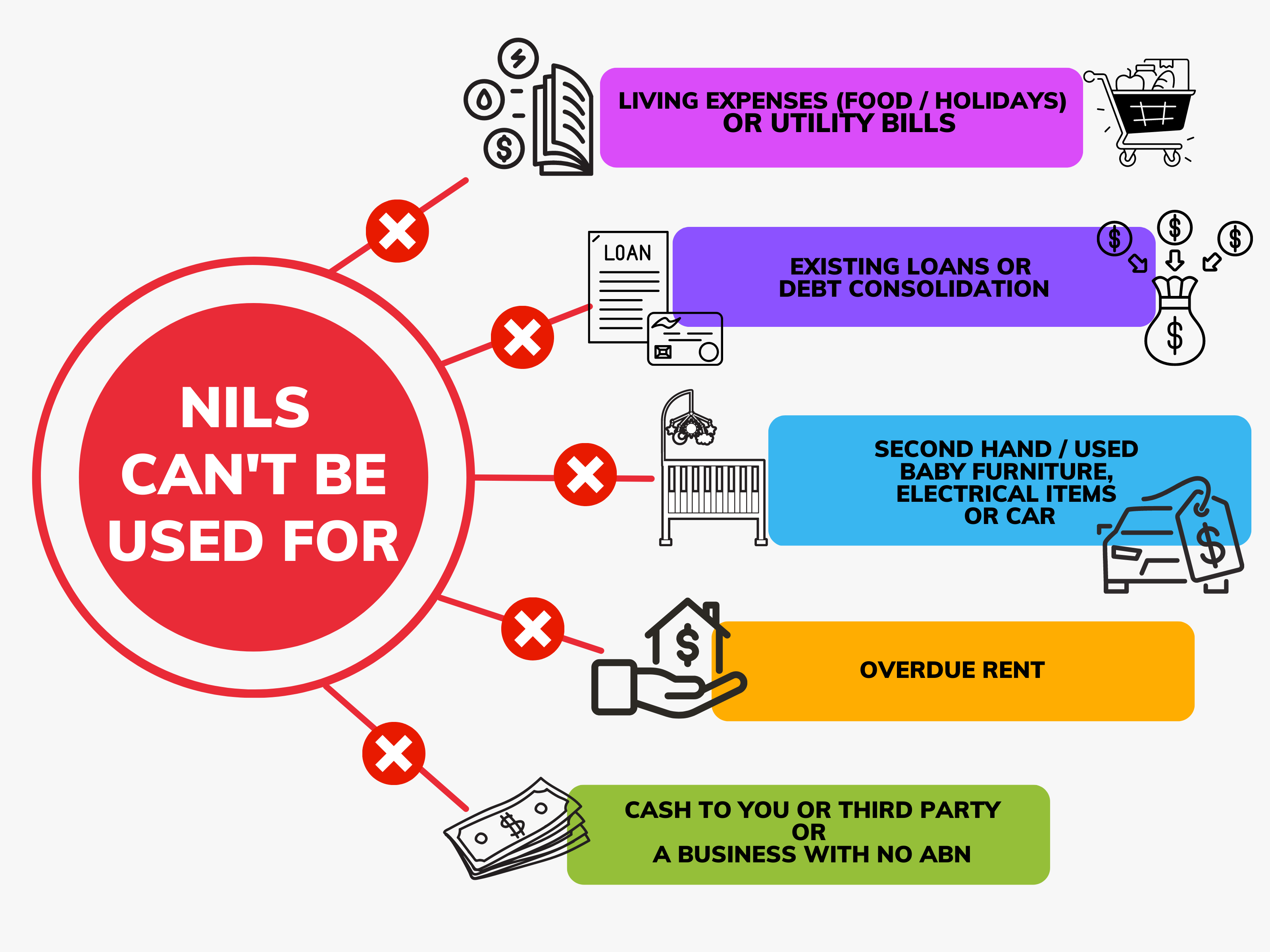

No-interest loans can’t be used to pay for things that have already happened (bills / debts).

No-interest loans also can’t be used to pay for:

- Overdue rental payments

- Living expenses (like food or holidays)

- Utility bills (Gas, power or phone)

- Second-hand or used baby items and electricals

- Cash advances

- Debt consolidation

- Payments for third-party private sales

- Used cars - refer to Good Shepherd no interest loans to purchase a car

No interest loans for vehicles is a specific loan product aimed at helping you buy a car. Not all NILS providers can help with this loan type. Refer to Good Shepherd no interest loans to purchase a car

If you are 18 years or older, and you meet our other eligibility criteria, you are entitled to apply.

This doesn’t count against you for a no interest loan.

When applying for a No Interest Loan of up to $2,000, there are NO credit checks. We’ll look at your income and expenses, the total loan amount, and your repayment timeframe (up to 24 months), and work with you to determine if you have the capacity to repay the loan.

We don’t judge you on your history.

When applying for a No Interest Loan of up to $2000, there are NO credit checks. We’ll look at your income and expenses, the total loan amount, and your repayment timeframe (up to 24 months), and work with you to determine if you have the capacity to repay the loan.

We don’t judge you on your history.

When you apply, you’ll need to provide:

- 100 points of ID (such as a Driver’s License or Passport, Medicare card or Health Care Card, bank card or bills, something to verify your address)

- Details about your financial situation (bank statements and/or banking details, payslips and/or Centrelink statements, plus a budget estimate of your regular expenses)

- Information that helps determine your capacity to repay the loan (such as existing debts)

- An invoice that shows a description of the item/service, the supplier’s details (business name, ABN, address, phone or email, banking or payment details), and the payment amount

If you haven’t chosen the exact item you’d like to buy, but know the rough amount, you can talk to us about ‘pre-approval’ to see if you’ll be eligible, then supply the invoice later.

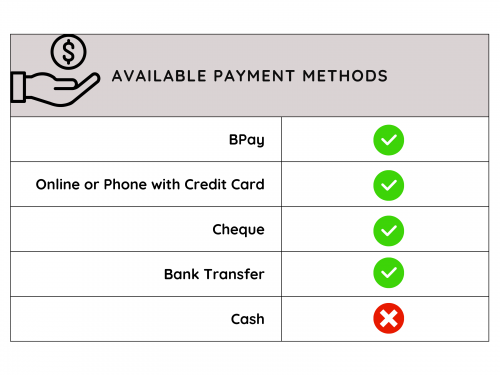

No Interest Loans CANNOT be used for cash. We pay the invoice directly to the supplier.

No interest loans is a safe credit product. This means we don’t do credit checks and we don’t have immediate access to financial information about and we can’t do ”quick checks” with “fast approval” like some of the “fast cash” services.

Depending on how quickly you can provide the requested information, it can take a few days to finalise and submit your loan application. If you have all requested supporting documents ready to send with your application, this will speed up the process.

Once your loan is submitted to the loan provider, we usually get an assessment decision in 24-48 hours.

If you have a current loan in arrears or you’ve had a previous no interest loan written off, you can’t apply for a new loan or a top-up loan until you’ve caught up what you owe (including write-off amounts).

To enquire about starting a loan application you can contact us using the link below, or you can call us on (02) 6241 0518 or email nils@salvationarmy.org.au

If no interest loans is suitable for you, you will be provided with information on the document requirements and details of how to apply.

At times we receive a high volume of enquiries. If your application is urgent, please let us know. We may refer you to another provider if we cannot meet your timeframe requirements.